AUTHORED BY: ARICA A.

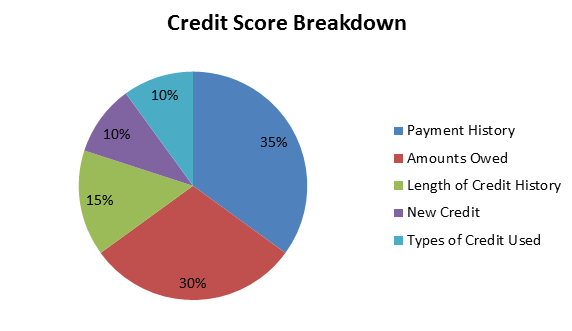

We all have dreams and goals in our lives. Whether it’s to buy a new car, own our own home, get out of debt or get a college degree- having a great credit score can help make your dreams a reality. While it will take some time to build your score, it will save you money and headaches in the long run. Let’s start by learning what information comes together to create your score. Following is a pie chart that breaks down the score and shows what factors have the most impact.

As you can see, there are multiple factors that make up your credit score. Whether your trouble spot is in the area that accounts for 35% or 10%, it all adds up to make an impact on your score. Let’s break each section down to see what is actually included in each segment.

Payment History (35%)

- One of the first questions that most lenders will ask is whether you have been on-time in paying your bills in the past. This is one of the most important factors of your score. While a few late payments here and there may not ultimately make or break your score, it is best to be in the habit of paying on-time, all the time.

- Your payment history is broken down into five different “account types” that include: Credit Cards (VISA, AMEX, etc.), Retail Accounts (Old Navy, TJ Maxx, etc.), Installment Loans (car or student loans), Finance Company Accounts and Mortgage Loans.

- It also includes public records and collection items. While older or smaller amounts can have less impact, larger and more recent amounts can really cause an issue. Negative factors can include: bankruptcies (these stay on your credit report for 7-10 years), foreclosures, lawsuits, wage attachments, liens and judgments. Your report will show how late your payments were, how much was owed, how recently they occurred and how many there are.

- If you believe that you are not going to be able to make a payment on time, call your creditor immediately. Often they will be willing to work out a payment plan with you that will allow you to pay what you owe without it affecting your payment history and will save you from being sent to collections.

- As a rule, having a clean payment record on the majority of your accounts will definitely give you a boost to your credit score.

Amounts Owed (30%)

- While owing money on your credit accounts doesn’t automatically make you a high-risk or lower your score, using a high percentage of your available credit can indicate that a you are in over your head and might not be able to make a timely payment on all that is owed.

- Even if you always pay off the balance on your card each month, your credit report will still show the balance for that month.

- While the total amount owed is taken into consideration, your score also considers the amount you owe on certain types of accounts (i.e. mortgages, credit cards).

- Avoid having multiple accounts with balances owed. This gives you a higher risk of not being able to pay. If you make a regular habit of nearly “maxing out” your credit cards, this can indicate that you might have trouble making payments in the future.

- Do you have a car or student loan? How much you still owe on the loan, compared to the original amount, can impact your score. Paying down your loan in a consistent manner is a good sign that you are responsible about managing your debt. While these loan amounts may sometimes seem like they are never going to be repaid, just keep chugging. You may be able to pay the loans off sooner than you think!

Length of History (15 %)

- As a general rule, the longer your credit history is, the higher your score will be. However, this does not mean that people with a relatively short credit history can’t have a high score. It is definitely about the cumulative look at your entire report.

- Your credit score takes into account the age of your oldest and newest account and the average age of all of your accounts. It also looks at how long certain accounts have been open and how long it’s been since they were used.

New Credit (10%)

- Now, more than ever, people have more credit and are on the lookout for a better deal for their card of choice. However, opening several new accounts in a short period can do more damage than good for your credit score. This is especially true if you have a shorter credit history.

- Checking your credit report does not impact your credit score as long as you are getting it from the credit reporting bureau or an authorized organization. In fact, checking your credit report can help you identify your trouble accounts and help you find errors on your report that, after being removed, might significantly improve your score.

- How many inquiries you have can impact your credit score. (An inquiry is a request from a lender for your credit report or score) Inquiries remain on your credit report for 2 years even though it only impacts your score for 12 months.

- Things to note: While inquiries usually have a small impact, many types of inquiries are considered “soft hits” and are not considered at all. Your score allows for you to shop around at different lenders for the best rate without getting penalized each time as long as the inquiries fall within a limited window of time.

Now that we have covered what is included in your score, let’s touch on what is NOT.

- Your credit score does not include any elements that might be a basis for discrimination. US law prohibits your score from considering: race, color, religion, national origin, sex and marital status.

- Your age is not included in your score.

- Your salary, job, title, employer, date employed and employment history are not factors of your credit score. However, these may all be things that are taken into consideration by your lender during the application process.

- Interest rates on your loans/credit cards/ lines of credit. Your credit score is based more on your total credit limit and your record of payment than the interest rate that each account has.

While at first it might seem like your credit score is just a number that has been randomly assigned to you, as you can see, there is definitely a method to the madness. Sometimes breaking it down can help you pinpoint where you problem spot is and can get you on the road to repairing your score. Whether your score is in the 500s or the 800s, it’s never a bad time to be intentional about building and maintaining your credit score.

Just remember, your credit score is not something you have to be afraid of but is something that can be a great tool to help you achieve your dreams.

One Reply to “”